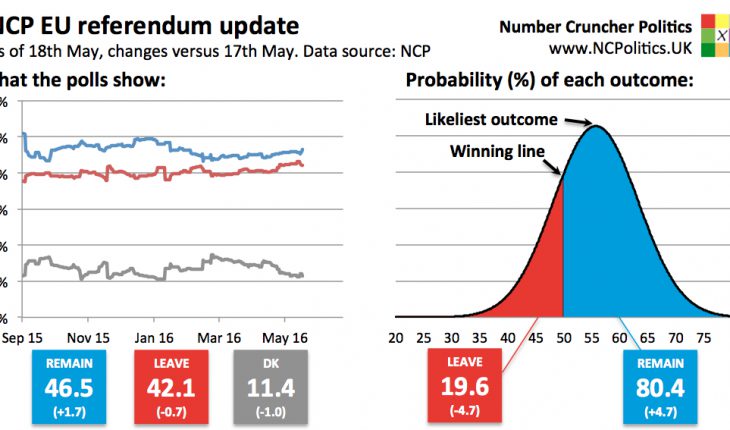

This week is turning out to be pretty eventful. Tonight's Evening Standard carries a (phone) poll from Ipsos MORI showing a huge 18-point lead (up from 10 points last month), following a less dramatic YouGov (online) poll for the Times showing a 4 point lead (up from 2 points last time) following some minor methodological changes. As I'll explain in a moment, the impact on the NCP forecast model is also significant.

First the polls themselves:

YouGov/Times (#EURef):

REMAIN 44 (+2)

LEAVE 40 (=)(Small impact from change to partisan weighting)https://t.co/z2vr09uuxB #EUreferendum

— NCP EU Referendum (@NCPoliticsEU) May 18, 2016

Ipsos MORI/Evening Standard (#EURef):

REMAIN 55 (+6)

LEAVE 37 (-2)Writeup https://t.co/1kx9ZX9ibd#EUreferendum #QueensSpeech

— NCP EU Referendum (@NCPoliticsEU) May 18, 2016

The MORI poll saw Twitter go bananas (to recycle a metaphor from yesterday) and even moved foreign exchange markets, with the Pound eventually jumping 2 cents against the Dollar compared with its intraday low:

Accidentally cropped the Y-axis on pound/dollar/polling chart. Here's a three-day perspective. Up 1% on the poll. pic.twitter.com/L6QZiYLeem

— Robert Hutton (@RobDotHutton) May 18, 2016

What has happened? The tables from the MORI poll shows a huge swing about Conservative voters compared with last month, when Leave led 50-42 among those that would vote Conservative in new election now. This month, Remain leads 60-34 among Tory voters – a greater margin than the overall average.

So we now have three phone polls showing swings towards Remain, and a mixed bag of online polls (one swining heavily towards Leave, the other two showing small moves in opposite directions). It does now seem as though the phone-online gap is widening again, with the spread between the extremes (in lead terms) now 22 points.

This makes it difficult to smooth through the noise, at a time when we’re seeing large and contradictory moves in polls. On consecutive days, TNS (see explanation from yesterday’s roundup) and Ipsos MORI have shown swings outside the margin of error in opposite directions. This volatility is compounded by the fact that there haven’t been many polls for a while (and no phone polls for even longer) meaning that more weight has to be placed on those we do have.

In spite of all of that, the forecast Remain share has only moved within a range of about 1 percentage point, now back up to a little over 56%. But because there are only six weeks to go, and the race, though not “neck-and-neck”, is relatively close, small moves in the projection will have substantial effects on the likelihood of the result being above or below the 50% winning line. For those readers in the financial markets (which is quite a few of you), it’s not unlike having a (roughly) at-the-money option, close to expiry, with a lot of volatility.

As such, the tight 20-24% range we’ve had so far reflects some unusually stable polls – yesterday’s and today’s moves reflect unusual instability. That said, the evidence overall suggests that things have shifted towards the in side, with the Brexit probability right at the low end of the range.

The EU referendum is getting quite a lot of attention from around the world and from people that would never normally poll watch. Many in the world of business are particularly interested in it, and earlier this week I spoke to Adam Payne at Business Insider about the referendum and last year’s general election. Here’s his writeup.

And finally, phone polls aren’t without their problems, in particular the fact that response rates have become worryingly low. But the most common compaint, which I’ve heard a few times today on social media, is “they’ve never called me”. Well at the moment, there are just five regular published phone polls, collectively sampling about 4,800 people a month. With over 26 million households in Great Britain, that implies that the average person should expect to get a call about once every 456 years. So please be patient!